Amortization Calculator

Calculate loan payments, interest cost, and a full amortization schedule (with optional extra payments).

| # | Date | Payment | Principal | Interest | Extra | Balance |

|---|

🔹 Table of Contents

- Amortization Calculator

- What Is Amortization

- How an Amortization Schedule Works

- Why Amortization Matters

- Loan Payment Formula

- How Extra Payments Change the Schedule

- Worked Example

- Interest vs Principal Over Time

- Real-World Uses

- Payment Frequency

- Rounding and Differences

- Extra Payment Strategies

- Assumptions

- Frequently Asked Questions

- References & Sources

🔹 What Is Amortization

Amortization is the process of paying off a loan over time with regular payments. Each payment is split into interest (the cost of borrowing) and principal (the amount that reduces your balance). Early in the loan, a larger share of your payment usually goes to interest; later, more goes to principal.

This amortization calculator generates an item-by-item schedule so you can see exactly how your balance drops each period and how much interest you pay overall. It’s especially useful for mortgages, auto loans, personal loans, and business loans.

🔹 How an Amortization Schedule Works

An amortization schedule is a table that shows the breakdown of every payment for the entire loan term. It typically includes:

- Payment number and date

- Total payment amount

- Interest charged for that period

- Principal paid (plus any extra payment)

- Remaining balance after the payment

🔹 Why Amortization Matters in Real Life

Knowing your amortization breakdown helps you make better decisions: compare loan offers, estimate total interest, plan extra payments, and understand how refinancing changes long-term cost. If you’re also budgeting for ownership costs, your Mortgage Calculator can complement this by estimating payment affordability (useful if you’re planning around home price, down payment, and term).

🔹 Quick Glossary

| Term | Meaning |

|---|---|

| Principal | The loan amount you still owe (excluding interest). |

| Interest | The borrowing cost charged by the lender, usually based on APR and your balance. |

| APR | Annual Percentage Rate; the yearly interest rate used to compute per-period interest. |

| Term | Total time to repay the loan (years/months). |

| Payment frequency | How often you pay (monthly, biweekly, weekly). |

| Extra payment | Additional amount applied to principal to reduce total interest and shorten payoff time. |

🔹 Loan Payment Formula

Most amortizing loans use a fixed payment each period. The payment is calculated from the loan amount, interest rate, and number of payments. Here’s the standard amortization payment formula:

Payment formula (fixed-rate loan):

Payment = P × r × (1 + r)^n ÷ ((1 + r)^n − 1)

| Symbol | What it means |

|---|---|

P |

Loan principal (starting loan amount). |

r |

Periodic interest rate (APR divided by payments per year). |

n |

Total number of payments (loan term × payments per year). |

🔹 How Periodic Interest Is Calculated

For each payment period, lenders typically calculate interest on the remaining balance:

Interest (this period) = Balance × r

Then the rest of the payment reduces principal:

Principal (this period) = Payment − Interest

🔹 How Extra Payments Change the Schedule

Extra payments are usually applied directly to principal. That reduces your balance faster, which means:

- less interest is charged in future periods

- the payoff date comes sooner

- total interest paid over the life of the loan decreases

If you’re exploring how much interest you could save by making additional payments, this amortization schedule shows the impact period-by-period. For quick comparisons between interest rates (for example, before refinancing), your Interest Rate Calculator can help estimate rate changes and scenarios.

🔹 Loan Payment Formula

Most amortizing loans use a fixed payment each period. The payment is calculated from the loan amount, interest rate, and number of payments. Here’s the standard amortization payment formula:

Payment formula (fixed-rate loan):

Payment = P × r × (1 + r)^n ÷ ((1 + r)^n − 1)

| Symbol | What it means |

|---|---|

P |

Loan principal (starting loan amount). |

r |

Periodic interest rate (APR divided by payments per year). |

n |

Total number of payments (loan term × payments per year). |

🔹 How Periodic Interest Is Calculated

For each payment period, lenders typically calculate interest on the remaining balance:

Interest (this period) = Balance × r

Then the rest of the payment reduces principal:

Principal (this period) = Payment − Interest

🔹 How Extra Payments Change the Schedule

Extra payments are usually applied directly to principal. That reduces your balance faster, which means:

- less interest is charged in future periods

- the payoff date comes sooner

- total interest paid over the life of the loan decreases

If you’re exploring how much interest you could save by making additional payments, this amortization schedule shows the impact period-by-period. For quick comparisons between interest rates (for example, before refinancing), your Interest Rate Calculator can help estimate rate changes and scenarios.

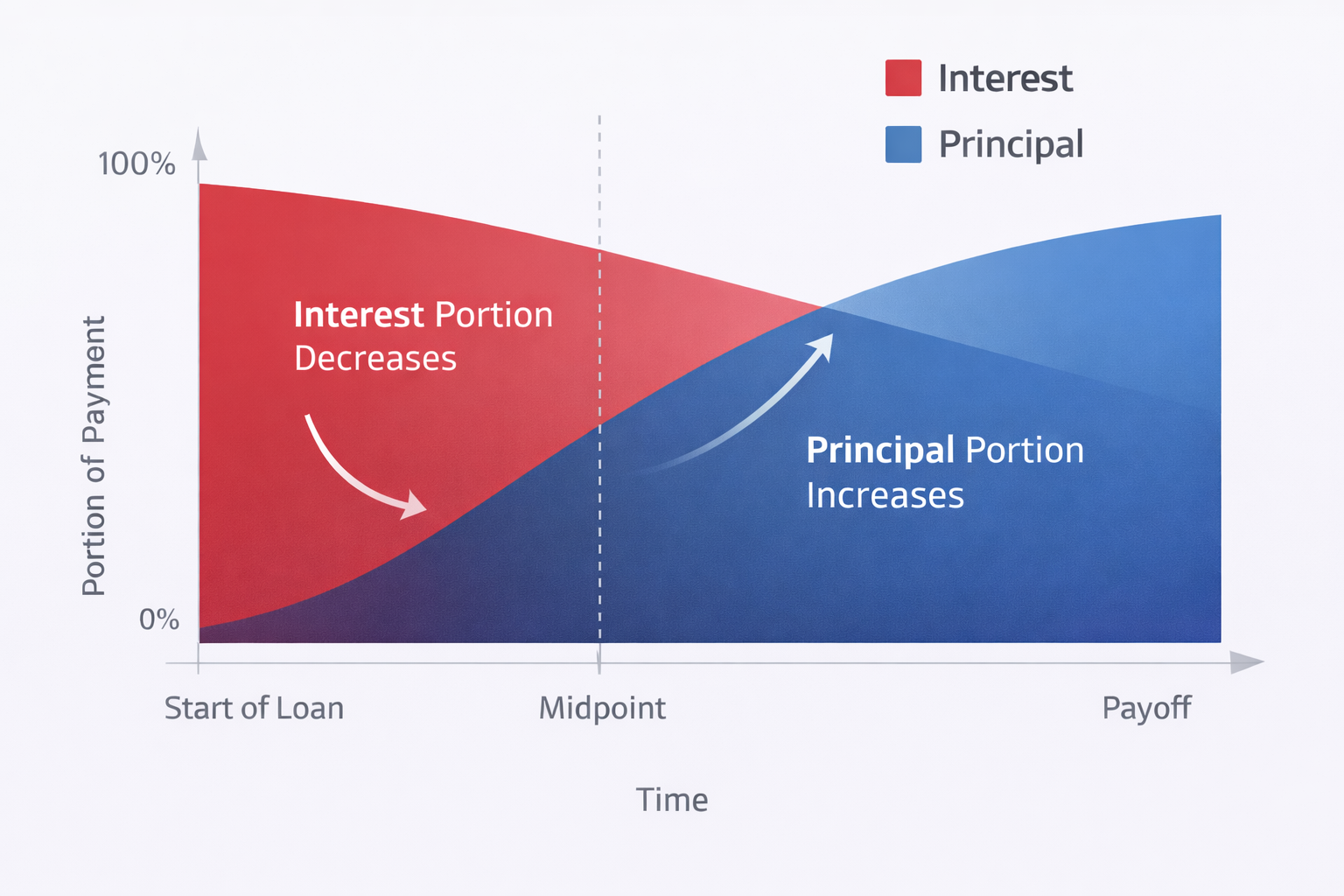

🔹 Interest vs Principal Over Time

In a typical fixed-rate amortizing loan, the interest portion is highest at the beginning because interest is calculated on the current balance. As the balance decreases, interest costs fall, and more of each payment goes toward principal. This is why early payments can feel “slow” when you’re trying to build equity or reduce debt quickly.

🔹 Why Extra Payments Save So Much Interest

Extra payments reduce the outstanding balance faster. Since interest is calculated on the balance each period, a lower balance means less interest the next period, and that savings compounds across the remaining term. Even small extra payments can have a noticeable long-term effect, especially on longer loans.

| Strategy | What changes | Typical impact |

|---|---|---|

| Shorter term (e.g., 15 vs 30 years) | More principal paid per period | Lower total interest, higher payment |

| Extra payment each period | Balance drops faster | Shorter payoff, lower total interest |

| Lower interest rate (refinance) | Periodic interest drops | Lower payment and/or lower interest cost |

🔹 Practical Ways to Use This Calculator

- Compare two loan offers with different rates and terms.

- Estimate interest savings if you add a fixed extra payment each period.

- Plan a payoff timeline when switching from monthly to biweekly payments.

- Preview your balance at a future date (useful for refinancing or selling an asset).

If you’re planning a refinance scenario, you can pair this amortization schedule with a Refinance Calculator to estimate how a new rate and term could change both monthly costs and lifetime interest.

🔹 Real-World Uses of an Amortization Calculator

An amortization calculator isn’t just for theory. It’s a practical planning tool used by homeowners, buyers, investors, and businesses to understand the true cost of borrowing and how debt changes over time.

🔹 Common Loan Types That Use Amortization

- Mortgages – Home loans where payments are spread across 15–30 years.

- Auto loans – Vehicle financing with fixed monthly payments.

- Personal loans – Installment loans with predictable payoff schedules.

- Business loans – Equipment and expansion loans with structured repayment.

- Student loans – Many repayment plans follow amortized structures.

🔹 Planning and Financial Decisions

Seeing the full amortization schedule helps you answer important questions:

- How much interest will I pay over the full term?

- When does the balance drop below a certain level?

- How much faster can I pay off the loan with extra payments?

- Is a shorter term worth the higher monthly payment?

For monthly budgeting and cash-flow planning, pairing this schedule with a Monthly Payment Calculator can help you balance affordability against long-term interest cost.

🔹 When Amortization May Not Apply

Not all loans are amortized. Credit cards, interest-only loans, and some short-term financing products calculate payments differently. In those cases, balances may not decrease automatically unless you pay more than the minimum required.

🔹 Payment Frequency and What It Changes

Payment frequency affects how often interest is applied and how quickly the balance decreases. In the calculator, the periodic interest rate is computed as:

Periodic rate = APR ÷ Payments per year

If you switch from monthly to biweekly or weekly, each payment is smaller, but you pay more often. Over a long term, more frequent payments can reduce total interest (especially if it results in slightly faster principal reduction).

| Frequency | Payments per year | Typical use |

|---|---|---|

| Monthly | 12 | Most mortgages and installment loans |

| Biweekly | 26 | Common payroll-style repayment plan |

| Weekly | 52 | Some short-term and structured repayment schedules |

🔹 Start Date and Schedule Dates

The start date is used to label each payment line in the amortization table. For monthly schedules, the calculator steps forward by calendar months. For weekly/biweekly schedules, it steps by 7 or 14 days. Lenders can sometimes use different conventions for exact due dates, especially around month-end, so treat dates as a planning guide rather than a legal schedule.

🔹 Rounding and Small Differences vs Lenders

It’s normal to see small differences between amortization calculators and lender statements because of rounding rules and lender-specific methods. Common causes include:

- rounding interest and principal each period to cents

- different day-count conventions (especially for non-monthly schedules)

- fees, escrow, insurance, or taxes not included in a “pure” loan schedule

- interest computed daily vs by fixed periodic rate

If you want to estimate an “all-in” monthly housing cost (not just the loan), your Mortgage Payment Calculator can help factor in additional costs like taxes and insurance.

🔹 Extra Payment Strategies

Extra payments are one of the simplest ways to reduce total interest and shorten your payoff timeline. Even a small amount paid consistently can create meaningful savings because interest is calculated on the remaining balance.

🔹 Common Extra Payment Approaches

| Approach | How it works | When it makes sense |

|---|---|---|

| Fixed extra per payment | Add the same extra amount each period (e.g., +$50 or +$200). | Steady income and long-term payoff plan. |

| Round up the payment | Pay a rounded number (e.g., $1,687.71 → $1,750). | Easy habit without tracking exact extra. |

| Biweekly repayment | Pay every two weeks (26 payments/year). | If you get paid biweekly and want a structured plan. |

| Occasional lump sums | Pay a larger amount when you can (bonus, tax refund). | Irregular cash inflows or seasonal income. |

🔹 How to Use the Extra Payment Field

In this calculator, the extra payment is applied to principal each period. This typically reduces:

- Total interest paid over the loan

- Number of payments needed to reach a $0 balance

- Payoff date

🔹 Important Notes Before Paying Extra

Some lenders require you to specify that extra money should be applied to principal, not future payments. If your loan has prepayment penalties or special terms, confirm the rules in your loan agreement.

If you’re deciding between paying extra on debt vs investing the money, your Compound Interest Calculator can help you compare potential investment growth against interest savings from faster loan payoff.

🔹 Key Assumptions Used by This Calculator

This amortization calculator is designed to model a standard fixed-rate amortizing loan. To keep results clear and comparable, it uses several common assumptions:

- The interest rate (APR) stays constant for the entire loan term.

- Each payment is made on schedule with no missed or late payments.

- Extra payments are applied directly to principal.

- No lender fees, penalties, or escrow charges are included.

🔹 What Is Not Included in the Schedule

The amortization table focuses only on the loan itself. Depending on the loan type, your real payment may include additional items not shown here:

- property taxes and homeowners insurance (common for mortgages)

- private mortgage insurance (PMI)

- origination fees or servicing fees

- late fees or penalties

🔹 Why Your Lender’s Numbers May Differ

Even when using the same loan details, amortization schedules can differ slightly between calculators and lenders. Typical reasons include:

- daily interest calculations instead of fixed periodic rates

- rounding rules applied at different steps

- day-count conventions (30/360 vs actual/365)

- payment timing differences around weekends or holidays

🔹 How to Use These Results

Use this calculator as a planning and comparison tool, not as a legal or contractual schedule. It’s ideal for estimating interest cost, testing extra payment strategies, and comparing loan options. For exact figures, always rely on your lender’s official loan disclosure or statement.

If you’re comparing multiple loan structures side by side, pairing this page with a Loan Comparison Calculator can help highlight which option fits your goals best.

🔹 Frequently Asked Questions

🔹 References & Sources

The explanations and formulas on this page were compiled using the following references.

| Source | What it was used for | Link |

|---|---|---|

| Consumer Financial Protection Bureau (CFPB) | Definition of amortization and explanation of how payment portions shift from interest to principal over time. | CFPB: What is amortization? |

| CFPB – Mortgage key terms | Plain-language definition of amortization and note that some loans do not fully amortize. | CFPB: Mortgages key terms |

| Federal Reserve | Amortization chart concept: principal portion increases over time while interest portion decreases. | Fed: Mortgage refinancings guide |

| Wikipedia – Amortization calculator | Standard fixed-payment amortization formula (including the zero-interest special case). | Wikipedia: Amortization calculator |

| Wikipedia – Amortization schedule | Definition of amortization schedule as a table of periodic payments with interest and principal components. | Wikipedia: Amortization schedule |

| Investopedia | General amortization concepts and how schedules show principal vs interest shifting over time. | Investopedia: Amortization |