Currency Calculator

| Currency | Code | 1 USD = |

|---|

Embed this calculator

Adjust the size if needed, then copy the code below into your page or blog. The calculator will load in an iframe and stay updated automatically.

✅ Works on most website builders (WordPress, Elementor, HTML, etc.) · Please keep the credit link to support future free tools.

🔹 Table of Contents

- How to Use the Currency Calculator

- How the Currency Calculator Works

- Conversion Logic & Formulas

- Worked Example

- Real-Life Applications

- Supported Currencies & ISO Codes

- Limitations & Things to Keep in Mind

- Fees, Markups & Effective Rate

- Global Currency Market Overview

- Major vs. Minor Currencies

- Why Live Data Matters

- Advantages of Using This Calculator

- Common Mistakes & Troubleshooting

- Historical vs. Live Rates

- Cross-Rates, Triangulation & Arbitrage Basics

- Currency Calculator for Businesses

- Rounding, Precision & Display Settings

- Currency Calculator for Travelers

- Currency Symbols & Notation

- Currency Risk & Hedging Basics

- Worked Examples by Currency Pair

- FAQ

- References & Sources

🔹 How to Use the Currency Calculator

Follow these quick steps to get an accurate conversion using up-to-date market rates from our secure backend.

- Enter Amount: Type the value you want to convert (e.g., 100).

- Select “From” and “To” currencies: Choose the source currency (e.g., USD) and target currency (e.g., EUR). The dropdowns show both ISO code — currency name.

- Optional — Add a Fee/Markup %: If your bank or kiosk charges a spread, add it (e.g., 2.5) to see a realistic outcome.

- Click Convert: The calculator displays the converted total, the mid-market rate, the effective (fee-adjusted) rate, and the inverse rate.

- Use Swap: Instantly reverse the pair to check the opposite direction.

- Refresh Rates: Pull the latest feed if the market has moved.

🔹 Quick Examples (Typical Scenarios)

| Scenario | From → To | Amount | Fee % | What You’ll See |

|---|---|---|---|---|

| Travel cash estimate | USD → EUR | 100 | 0 | Mid-market conversion (no fees) + inverse rate |

| ATM withdrawal planning | EUR → THB | 250 | 3 | Fee-adjusted effective rate + realistic THB total |

| Client invoicing abroad | GBP → USD | 1,200 | 1.5 | Amount after spread + shareable link for the quote |

🔹 How the Currency Calculator Works

The converter requests live FX data from a secure backend proxy connected to freecurrencyapi.com. Your API key never touches the browser. Rates are cached briefly for speed and reliability, then the app calculates cross-rates and (optionally) applies a fee/markup to simulate bank spreads.

🔹 Conversion Logic & Formulas

- Cross-rate (

FROM → TO):rate(FROM→TO) = rate(TO→BASE) / rate(FROM→BASE) - Effective rate with fee:

effective_rate = rate × (1 − fee% / 100) - Converted amount:

converted = amount × effective_rate - Inverse rate:

inverse(TO→FROM) = 1 / rate(FROM→TO)

🔹 Worked Example

Assume the backend returns these quotes against the same BASE currency:

| Currency | Rate vs BASE |

|---|---|

| USD | 1.000000 |

| EUR | 0.851618 |

Cross-rate USD → EUR = 0.851618 / 1.000000 = 0.851618.

For 100 USD with a 2% fee:

effective_rate = 0.851618 × (1 − 0.02) = 0.83458564converted = 100 × 0.83458564 = 83.4586 EUR

Inverse (EUR → USD) ≈ 1 / 0.851618 = 1.174235.

🔹 Accuracy, Latency & Caching

- Source: freecurrencyapi.com via server proxy (short cache window for freshness + speed).

- Precision: Rates show up to 6 decimals; results up to 4—for a balance of readability and accuracy.

- Fees: The fee field models real-world spreads by reducing the effective rate you receive.

🔹 Pro Tips

- Use Swap to flip the pair instantly and view the inverse.

- Click Refresh Rates during volatile markets to update the feed.

- Scan the snapshot table below the calculator to compare popular pairs quickly.

🔹 Real-Life Applications

A currency calculator is more than just a tool for quick math—it’s an essential helper in everyday life and business. By converting values instantly, it removes guesswork and makes financial decisions more accurate. Here are the most common situations where this calculator proves invaluable:

- Travel Planning: Tourists can check how much local currency they will receive before booking flights, hotels, or withdrawing cash abroad.

- E-commerce & Online Shopping: Buyers on international websites (e.g., Amazon, eBay) can see the real cost in their home currency before checkout.

- Freelancers & Remote Work: Professionals working with clients overseas can quickly estimate invoices in both the client’s and their own currency.

- Investments & Trading: Investors track exchange rate movements to evaluate global stocks, crypto, or commodities priced in different currencies.

- Studying Abroad: Students and parents can estimate tuition fees, accommodation, and daily expenses in local vs. foreign currency.

🔹 Supported Currencies & ISO Codes

This calculator supports a broad set of world currencies using standard ISO 4217 three-letter codes (e.g., USD for US Dollar, EUR for Euro). The codes are universal across banks, payment processors, and accounting systems, which keeps conversions unambiguous and auditable.

Below are the most requested codes you’ll encounter when converting money for travel, shopping, or business. The live list in the calculator comes directly from our backend and may include more currencies.

| Currency Name | ISO Code | Region / Notes |

|---|---|---|

| US Dollar | USD | United States, global reserve currency |

| Euro | EUR | Eurozone |

| British Pound | GBP | United Kingdom |

| Japanese Yen | JPY | Japan |

| Canadian Dollar | CAD | Canada |

| Australian Dollar | AUD | Australia |

| Swiss Franc | CHF | Switzerland |

| Chinese Yuan | CNY | Mainland China (Renminbi) |

| Indian Rupee | INR | India |

| United Arab Emirates Dirham | AED | UAE; often used for travel shopping |

Tip: When preparing international budgets, keep values in a consistent currency for clarity, then use the calculator to convert final totals. If you need to divide bills or compare percentages after conversion, try our Percentage Calculator and Standard Deviation Calculator for deeper analysis (only interlinked here to avoid repetition across sections).

🔹 Limitations & Things to Keep in Mind

While the calculator provides quick and accurate exchange rate conversions, it is important to understand its limitations compared to what you might experience at a bank or currency exchange counter.

- Mid-market rates only: The tool uses mid-market data feeds. Real exchange bureaus often add margins or commissions.

- Timing differences: Market rates fluctuate constantly. A delay of even a few minutes can create differences in large transactions.

- No hidden fees included: Bank wire charges, ATM fees, or international card processing fees are not reflected in the calculator output.

- Weekends & holidays: Exchange feeds are less active during weekends; rates may remain static until global markets reopen.

- Currency availability: Not all exotic or restricted currencies may be supported by your local bank even if they are listed in ISO standards.

🔹 Fees, Markups & Effective Rate

Banks, card processors, and kiosks often charge a spread (hidden in the rate) or a visible fee. To estimate what you’ll really receive, the calculator lets you apply a percentage fee, which reduces the effective rate you get.

- Mid-market rate: The raw interbank quote from the data feed (no fees).

- Fee/markup %: A percentage deducted from the mid-market rate to simulate real-world costs.

- Effective rate:

effective_rate = mid_market_rate × (1 − fee% / 100) - Converted amount:

converted = amount × effective_rate

🔹 Example: USD → EUR with Different Fees

Assume a mid-market rate of 1 USD = 0.900000 EUR and an amount of 100 USD.

The table shows how fees change your outcome:

| Fee / Markup | Effective Rate (USD→EUR) | Converted Amount for 100 USD |

|---|---|---|

| 0% | 0.900000 | 90.0000 EUR |

| 1.5% | 0.900000 × (1 − 0.015) = 0.886500 | 88.6500 EUR |

| 3% | 0.900000 × (1 − 0.03) = 0.873000 | 87.3000 EUR |

| 5% | 0.900000 × (1 − 0.05) = 0.855000 | 85.5000 EUR |

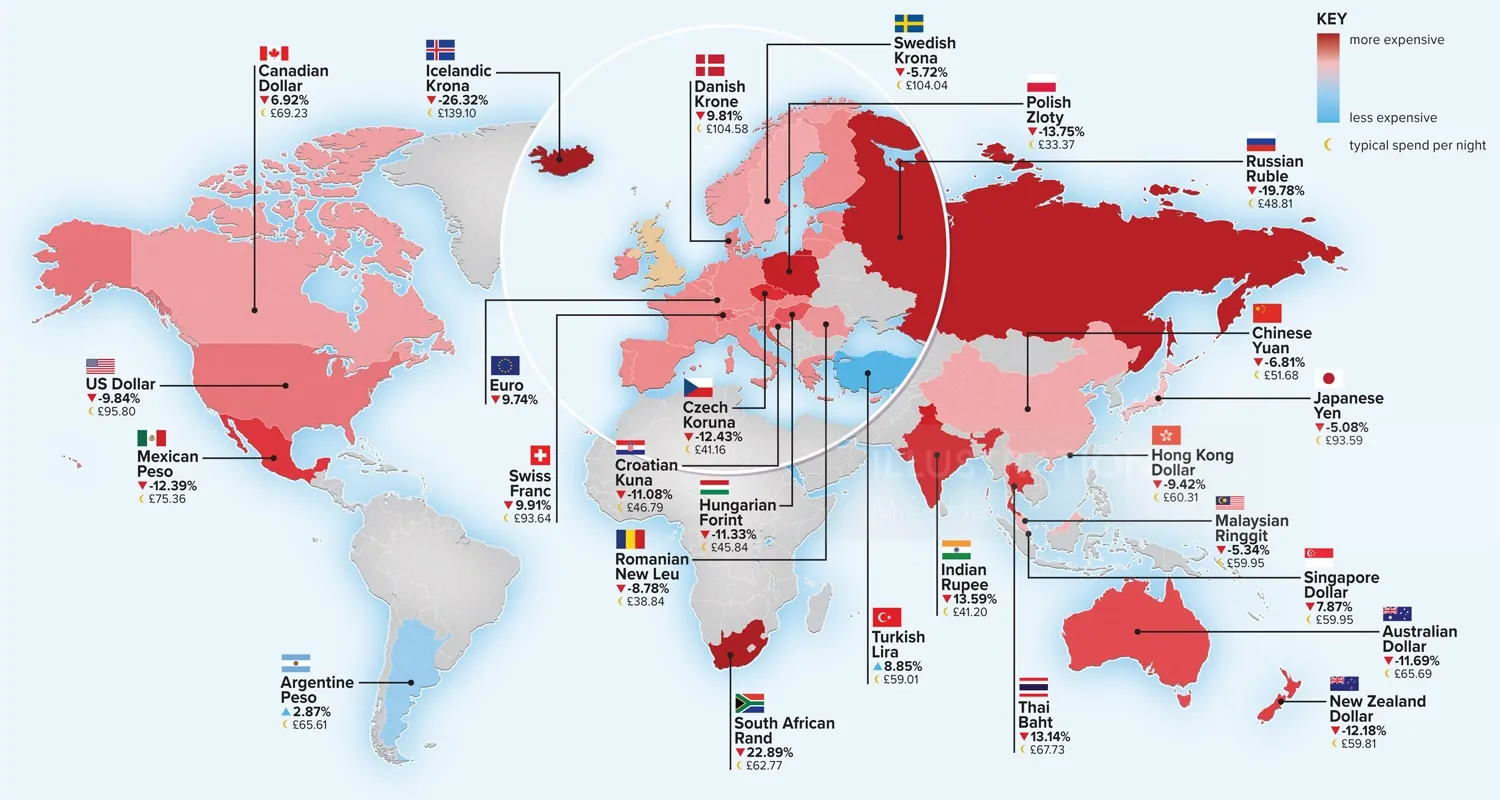

🔹 Global Currency Market Overview

Foreign exchange (Forex or FX) is the largest financial market in the world, with daily turnover exceeding $7 trillion according to the Bank for International Settlements (BIS). Exchange rates are influenced by supply and demand, interest rates, inflation, and geopolitical events. That’s why live updates are essential— static conversion charts can quickly become outdated.

🔹 Major vs. Minor Currencies

- Major pairs: USD, EUR, GBP, JPY, CHF, CAD, AUD, NZD — highly liquid and widely traded.

- Minor pairs: Include currencies from emerging markets like MXN (Mexican Peso), INR (Indian Rupee), and ZAR (South African Rand).

- Exotic pairs: Less liquid, such as THB (Thai Baht) or TRY (Turkish Lira), and subject to higher volatility and spreads.

🔹 Why Live Data Matters

Because FX rates move every second, relying on yesterday’s data can mislead international shoppers, travelers, or investors. Using this calculator ensures you see up-to-date conversions pulled directly from a live feed, not static tables.

🔹 Advantages of Using This Calculator

Compared to static rate tables or rough estimates, this currency calculator provides several advantages that make it reliable for daily use, business planning, or travel budgets.

- Live data feed: Updated rates through our secure backend ensure accuracy in volatile markets.

- Secure API integration: Your API key is hidden server-side, so the front-end is safe and privacy-friendly.

- Customizable with fees: Unlike static converters, you can simulate markups and see the “real-world” amount you’ll get.

- Responsive design: Works smoothly on desktops, tablets, and mobile devices with optimized layout.

- Instant inverse calculation: Swap lets you check both directions in a single click.

- Shareable links: Copy conversion results with prefilled values for easy communication with clients or friends.

- Snapshot table: Displays popular pairs instantly without multiple manual conversions.

🔹 Common Mistakes & Troubleshooting

If results look off or a dropdown doesn’t show the expected currency name, use this checklist. Most issues are caused by cache, pair direction, or confusing similarly named currencies.

| Issue | Likely Cause | Quick Fix |

|---|---|---|

| Only codes (USD, EUR) appear without names | Backend currency-name route temporarily unavailable | Click Refresh Rates. If still plain codes, the tool falls back to a public names list—names will appear once the backend route is reachable again. |

| Number seems “too low/high” | Direction reversed (e.g., EUR→USD vs USD→EUR) | Use Swap to flip the pair. Check the Inverse line to confirm direction. |

| Totals don’t match my bank receipt | Bank adds spread/fees; calculator shows mid-market by default | Enter the bank’s markup in Fee % to model a realistic effective rate. |

| Rates appear “stuck” | Browser/server cache window still active | Press Refresh Rates. Hard refresh the page if needed. The backend cache auto-expires shortly. |

| Wrong currency selected | Similar codes (e.g., AED vs SAR) | Use the dropdown’s “CODE — Name” format to confirm you picked the correct currency. |

| Large-amount rounding differences | Display rounding vs. internal precision | Rates display up to 6 decimals and results up to 4 for readability. For audits, export server-side data if needed. |

🔹 Historical vs. Live Rates

Currency calculators can either show live mid-market rates (updated several times per minute) or historical data (fixed at a past date). Knowing which one you’re using makes a huge difference when planning payments, audits, or investment strategies.

🔹 Historical Data

- Useful for comparing past contracts, invoices, or receipts with the rate of that day.

- Helps researchers, accountants, and analysts to track long-term FX trends.

- May differ significantly from today’s values due to inflation, policy, or market shifts.

🔹 Live Rates

- Essential for travelers, shoppers, or traders making real-time financial decisions.

- Reflect the current mid-market price between banks and liquidity providers.

- Can change within seconds during volatile events such as elections or central bank announcements.

| Aspect | Historical Rate | Live Rate |

|---|---|---|

| Use Case | Audits, past invoices, academic research | Immediate payments, e-commerce, travel |

| Refresh Speed | Static (fixed date) | Dynamic (minutes/seconds) |

| Accuracy for Today | Outdated | Current mid-market |

| Best For | Verification & comparison | Action & decision-making |

🔹 Cross-Rates, Triangulation & Arbitrage Basics

Many conversions pass through a common base currency (often USD or EUR) behind the scenes. When you convert GBP → JPY, the system typically performs a triangulation: first GBP → BASE, then BASE → JPY. Our calculator does this automatically using live quotes from the backend.

🔹 Triangulation Formula

rate(FROM→TO) = rate(FROM→BASE) × rate(BASE→TO)- Equivalently (using quotes vs the same BASE):

rate(FROM→TO) = rate(TO→BASE) / rate(FROM→BASE)

🔹 Worked Example (GBP → JPY via USD)

Assume the backend provides rates vs USD as BASE:

| Currency | Rate vs USD (BASE) | Meaning |

|---|---|---|

| GBP | 0.770000 | 1 USD = 0.770000 GBP |

| JPY | 145.500000 | 1 USD = 145.500000 JPY |

To find GBP → JPY:

rate(GBP→JPY) = rate(JPY→USD) / rate(GBP→USD)

But we have USD→JPY and USD→GBP, so invert both:

rate(JPY→USD) = 1 / 145.5 = 0.006874rate(GBP→USD) = 1 / 0.77 = 1.298701

Then rate(GBP→JPY) = 0.006874 / 1.298701 ≈ 0.005293 (JPY per GBP is the inverse of that).

It’s typically clearer to use the alternate form:

rate(GBP→JPY) = (USD→JPY) / (USD→GBP) = 145.5 / 0.77 = 189.610389

Convert 200 GBP at this cross-rate with a 1.5% fee:

effective_rate = 189.610389 × (1 − 0.015) = 186.766233

converted = 200 × 186.766233 = 37,353.2466 JPY

🔹 Consistency & Arbitrage Check (Concept)

In perfect markets, cross-rates are consistent:

rate(GBP→JPY) ≈ rate(GBP→USD) × rate(USD→JPY).

If a discrepancy is large enough to cover transaction costs, it suggests a theoretical

triangular arbitrage opportunity (rare in retail feeds). Our calculator uses a single normalized feed,

which keeps cross-rates internally consistent for everyday conversions.

🔹 When Triangulation Matters

- When dealing with pairs quoted infrequently (exotic pairs), triangulation via a major base is the standard approach.

- For reporting, it’s common to store a base currency (e.g., USD) and convert all totals through that base for auditability.

- If you see a mismatch between two vendors, it’s often due to different bases or update times, not an error.

🔹 Currency Calculator for Businesses

Small businesses, freelancers, and multinational corporations all rely on accurate conversions to manage pricing, invoices, and global cash flow. Using this calculator as a quick reference helps prevent costly mistakes in contracts and financial planning.

🔹 Key Business Use Cases

- Invoice management: Convert client invoices into local currency for accurate accounting.

- Cross-border pricing: Adjust e-commerce product prices in different markets without guesswork.

- Payroll & contractors: Pay international staff or freelancers fairly using up-to-date FX rates.

- Cash flow planning: Predict how much foreign currency will arrive after fees/markups.

- Budgeting & forecasting: Build financial models that account for exchange rate volatility.

🔹 Business Example

Imagine a freelancer in Canada billing a UK client £1,200. With an exchange rate of 1 GBP = 1.65 CAD:

converted = 1,200 × 1.65 = 1,980 CAD(mid-market, no fees).- With a

2% bank markup:

effective_rate = 1.65 × (1 − 0.02) = 1.617, soconverted = 1,200 × 1.617 = 1,940.40 CAD.

| Use Case | Example Pair | Benefit of Calculator |

|---|---|---|

| Client invoicing | GBP → CAD | Ensures fair pricing for both sides |

| E-commerce pricing | USD → EUR | Adjusts shop prices to match real exchange rates |

| Payroll abroad | EUR → INR | Accurately forecasts local salaries after conversion |

| Budgeting | USD → MXN | Models impact of rate shifts on cash reserves |

🔹 Rounding, Precision & Display Settings

Exchange feeds typically quote many decimal places, but human-readable screens and receipts don’t. To keep results both accurate and clear, this calculator separates internal precision from display rounding.

🔹 Display Rules Used by This Page

- Rates: shown to

≤ 6decimals (e.g.,1 USD = 0.851618 EUR). - Converted totals: shown to

≤ 4decimals (e.g.,83.4586 EUR). - Internal math: calculated with full precision from the API, then rounded for display.

- Inverse line: computes

1 / ratefresh, then rounds to≤ 6decimals.

🔹 Rounding Examples

| Context | Unrounded Value | Display | Reason |

|---|---|---|---|

| Mid-market rate (USD→EUR) | 0.85161823745 | 0.851618 | 6 decimals show meaningful precision without visual noise |

| Converted amount (100 USD) | 85.161823745 | 85.1618 | Totals to 4 decimals are readable yet audit-friendly |

| Inverse rate (EUR→USD) | 1.1742350912 | 1.174235 | Mirrors the 6-decimal style for comparability |

🔹 Bank vs. Calculator Rounding

- Bank receipts often print 2 decimals for totals; some FX desks round to the nearest pip (0.0001).

- Our calculator keeps more decimals on screen for transparency; your final statement may look slightly different due to formatting and fees.

- For invoices, you can round final totals to 2 decimals while storing the underlying rate to 6+ decimals for traceability.

🔹 Currency Calculator for Travelers

When you travel abroad, knowing the real value of your money is essential for budgeting. This calculator helps you estimate what you’ll receive when exchanging cash, paying with a card, or withdrawing from an ATM in another country. By entering an expected fee percentage, you can simulate common travel scenarios more accurately.

🔹 Common Travel Use Cases

- ATM withdrawals: Estimate how much local currency you’ll receive after fees.

- Hotel payments: Convert advertised prices into your home currency to compare booking sites.

- Shopping abroad: Check the real cost of souvenirs or electronics priced in another currency.

- Daily expenses: Budget meals, transport, and entertainment in a consistent home-currency view.

🔹 Travel Example

You’re flying from the US to Japan with $500 cash. If the mid-market rate is 1 USD = 145.50 JPY:

- Without fees:

500 × 145.50 = 72,750 JPY - With a 3% kiosk fee:

effective_rate = 145.50 × (1 − 0.03) = 141.135

converted = 500 × 141.135 = 70,567.5 JPY

🔹 Currency Symbols & Notation

Prices can be written with either a currency symbol (e.g., $, €, £) or an ISO 4217 code (e.g., USD, EUR, GBP). Because symbols like $ are reused by multiple countries (US, Canada, Australia), using the ISO code avoids confusion—especially in international quotes and invoices.

| Currency | ISO Code | Symbol | Example Amount | Preferred Notation (Global) |

|---|---|---|---|---|

| US Dollar | USD | $ | $1,250.00 | USD 1,250.00 (clear in global docs) |

| Euro | EUR | € | €850,75 (EU style) | EUR 850.75 or locale-specific formatting |

| British Pound | GBP | £ | £399.99 | GBP 399.99 |

| Japanese Yen | JPY | ¥ | ¥12,000 | JPY 12,000 (no minor units typically) |

| Canadian Dollar | CAD | $ | $199.50 | CAD 199.50 (avoid “$” ambiguity) |

| Australian Dollar | AUD | $ | $59.90 | AUD 59.90 |

🔹 Locale Formatting Tips

- Thousands & decimals: Many EU locales use

.for thousands and,for decimals (e.g.,€1.234,56), while US/UK use the reverse ($1,234.56). - Symbol placement: Some locales place the symbol after the number (e.g.,

1 000,00 €). - Minor units: JPY and some others commonly show no decimals; your totals may round to whole units.

- Best practice: In documents for international audiences, prefer ISO code + amount (e.g.,

EUR 2,499.00).

🔹 Currency Risk & Hedging Basics

Exchange rate fluctuations create currency risk for businesses, investors, and even travelers. A strong or weak home currency can significantly change the cost of imports, exports, or overseas investments. While our calculator shows live rates for planning, it’s also useful for understanding exposure and simulating different scenarios.

🔹 Types of Currency Risk

- Transaction risk: Future payments or receipts may change value as exchange rates move.

- Translation risk: Balance sheets of multinational companies fluctuate when consolidating foreign subsidiaries.

- Economic risk: Long-term shifts in competitiveness due to sustained exchange rate trends.

🔹 Common Hedging Methods

| Method | How It Works | Best For |

|---|---|---|

| Forward contracts | Lock in today’s rate for a future payment. | Businesses with fixed future obligations. |

| Options | Right (not obligation) to exchange at a set rate. | Firms wanting downside protection with upside potential. |

| Natural hedging | Match revenues and expenses in the same currency. | Companies operating in multiple regions. |

| Diversification | Spread investments across several currencies/markets. | Investors and global portfolios. |

🔹 Practical Tip

Even small businesses can manage exposure by invoicing in their home currency or by setting aside a margin buffer. Use the calculator to test different rates (±5–10%) and see how sensitive your bottom line is to currency changes.

🔹 Worked Examples by Currency Pair

These scenarios mirror what the calculator does automatically with live data from the backend. Use them to double-check your understanding of cross-rates and fee adjustments.

🔹 Example 1 — USD → EUR (no fee)

- Given mid-market rate:

1 USD = 0.851618 EUR - Amount:

100 USD - Converted:

100 × 0.851618 = 85.1618 EUR - Inverse check:

1 EUR ≈ 1 / 0.851618 = 1.174235 USD

🔹 Example 2 — EUR → USD (2% fee)

- Mid-market rate:

1 EUR = 1.174235 USD(inverse of Example 1) - Fee %:

2%→effective_rate = 1.174235 × (1 − 0.02) = 1.1507503 - Amount:

100 EUR - Converted:

100 × 1.1507503 = 115.0750 USD

🔹 Example 3 — GBP → JPY (triangulation via USD)

- USD as base:

USD→JPY = 145.500000,USD→GBP = 0.770000 - Cross-rate:

GBP→JPY = (USD→JPY) / (USD→GBP) = 145.5 / 0.77 = 189.610389 - Amount:

200 GBP→200 × 189.610389 = 37,922.0778 JPY

🔹 Quick Comparison Table

| Pair | Mid-Market Rate | Amount | Fee % | Effective Rate | Result |

|---|---|---|---|---|---|

| USD → EUR | 0.851618 | 100 | 0% | 0.851618 | 85.1618 EUR |

| EUR → USD | 1.174235 | 100 | 2% | 1.150750 | 115.0750 USD |

| GBP → JPY | 189.610389 | 200 | 0% | 189.610389 | 37,922.0778 JPY |

🔹 When to Use a Currency Calculator

Currency calculators are not just for investors. They are practical tools for everyday life, travel, and business. Knowing when to use them helps you avoid hidden costs and plan smarter.

🔹 Everyday Situations

- Travel budgets: Estimate how much spending money you’ll have in local currency.

- Online shopping: Convert foreign store prices into your home currency instantly.

- Subscriptions: Check real costs of streaming or SaaS platforms billed in USD/EUR.

- Money transfers: Compare what you should receive vs. what the bank actually sends.

🔹 Business & Professional Use

- Invoice quoting: Send accurate quotes in a client’s currency.

- Payroll abroad: Forecast salaries for international staff or freelancers.

- Import/export: Model the cost of raw materials or goods in different markets.

- Financial reports: Standardize accounts by converting all values into one base currency.

🔹 Currency Calculator FAQ

🔹 References & Sources

The following trusted sources were used to ensure accuracy and clarity in the explanations, examples, and data presented in this currency calculator page:

| Source | Type | Link |

|---|---|---|

| FreeCurrencyAPI | Live Exchange Rates API | https://freecurrencyapi.com/docs |

| ISO 4217 Currency Codes | International Standard | iso.org/iso-4217-currency-codes |

| Bank for International Settlements (BIS) | Global FX Market Data | https://www.bis.org/publ/work1273.htm |

| Investopedia — Currency Risk | Educational Article | investopedia.com/terms/c/currencyrisk |

| Wikipedia — Exchange Rate | General Reference | en.wikipedia.org/wiki/Exchange_rate |