Tip Calculator

Choose a symbol or type your own (max 3 chars). Custom overrides the dropdown.

Set to 1 if you’re paying alone.

Results

Tip

Total

Embed this calculator

Adjust the size if needed, then copy the code below into your page or blog. The calculator will load in an iframe and stay updated automatically.

✅ Works on most website builders (WordPress, Elementor, HTML, etc.) · Please keep the credit link to support future free tools.

🔹 Tip Formula

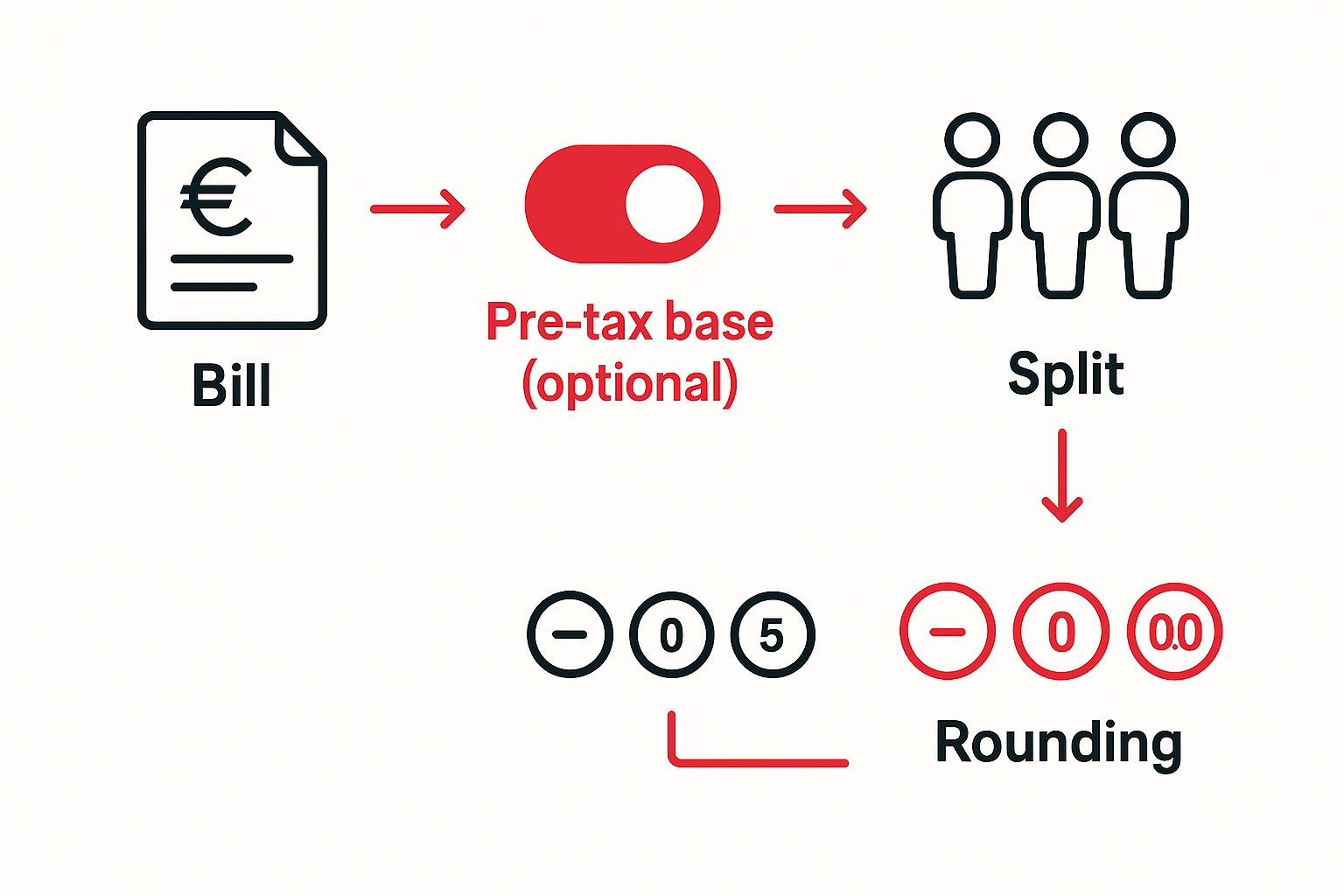

The calculator applies a percentage to your chosen tip base and then adds the tip back to the bill. If you enable the “pre-tax amount” toggle and provide a tax rate, the tip base becomes the estimated bill before tax.

| Concept | Formula |

|---|---|

| Pre-tax base (optional) | base = bill / (1 + tax_rate) (tax_rate as decimal, e.g., 13.5% → 0.135) |

| Tip amount | tip = base × tip_percent (e.g., 15% → 0.15) |

| Total bill | total = bill + tip |

| Per-person tip | tip_per_person = tip / people |

| Per-person total | total_per_person = total / people |

🔹 When to Use Pre-Tax Tip

In many regions, etiquette suggests tipping on the service value before sales tax. If that’s your preference, enable the pre-tax toggle and enter the local tax rate so the calculator estimates a pre-tax base automatically.

🔹 Rounding Options

- No rounding: Show exact math to 2 decimals.

- Round tip: Make the tip a whole currency unit.

- Round total bill: Make the final total a whole currency unit.

- Round per-person total: Keep per-person figures readable at 2 decimals.

🔹 Quick Example

Bill = €58.40, People = 2, Tip% = 15%, Pre-tax off →

tip = 58.40 × 0.15 = €8.76,

total = 58.40 + 8.76 = €67.16,

per-person total = 67.16 / 2 = €33.58.

🔹 Choosing a Tip Percentage

There’s no universal rule, but most diners use 10–20% as a starting range and adjust for service quality, complexity, and local norms. Use this guide to pick a fair, transparent percentage before you split the bill.

| Context | Common Range | Notes |

|---|---|---|

| Sit-down restaurant (table service) | 15–20% of the bill | Adjust up for large parties, complex orders, or exceptional service. |

| Counter service / café | 0–10% | Optional; consider 5–10% if there’s food prep or special handling. |

| Delivery | 10–15% | Factor in distance, weather, and order size. |

| Bar (table or counter) | €1–€2 per drink or 10–15% | Choose per-drink for simple orders; percent for rounds/tabs. |

| Hotel staff (bellhop, housekeeping) | €1–€5 per service | Varies by role and property; tip per bag or per night. |

| Takeout / pickup | 0–10% | Often optional; consider a small tip for large or custom orders. |

🔹 When to Adjust Up or Down

- Increase for special requests, dietary accommodations, or above-and-beyond attention.

- Decrease carefully for consistent issues after raising concerns (kitchen delays aren’t always the server’s fault).

- Check local norms when traveling—some regions include service charges.

Need to convert tip % into a precise value for other scenarios? Try our Percent Calculator.

🔹 Split & Rounding Scenarios

These realistic examples show how the calculator handles splitting, tax-aware tipping, and rounding. Change the numbers in the calculator above to mirror any scenario here.

| Example | Inputs | Math | Results |

|---|---|---|---|

| Simple dinner for two |

Bill €58.40, People 2, Tip 15% Pre-tax off, No rounding |

tip = 58.40 × 0.15 = €8.76 total = 58.40 + 8.76 = €67.16 |

Tip/pp = €8.76 / 2 = €4.38 Total/pp = €67.16 / 2 = €33.58 |

| Group of five, round total |

Bill €142.10, People 5, Tip 12.5% Pre-tax off, Rounding: Total to whole unit |

tip = 142.10 × 0.125 = €17.76 total ≈ €159.86 → €160 (rounded) new tip = 160 − 142.10 = €17.90 |

Total/pp = 160 / 5 = €32.00 Tip/pp = 17.90 / 5 = €3.58 |

| Pre-tax base with 13.5% tax |

Bill €84.00 (tax included), People 3, Tip 18% Pre-tax on, Tax 13.5%, No rounding |

base = 84 / 1.135 = €74.01 tip = 74.01 × 0.18 = €13.32 total = 84 + 13.32 = €97.32 |

Tip/pp = €13.32 / 3 = €4.44 Total/pp = 97.32 / 3 = €32.44 |

| Round per-person to 2 decimals |

Bill €51.75, People 4, Tip 20% Pre-tax off, Rounding: Per-person |

tip = 51.75 × 0.20 = €10.35 total = 62.10 |

Tip/pp = 10.35 / 4 = €2.5875 → €2.59 Total/pp = 62.10 / 4 = €15.525 → €15.53 |

🔹 Quick Steps

- Enter your bill and (optionally) enable pre-tax with a tax rate.

- Pick a tip percent or tap a preset (10–20%).

- Set how many people are splitting.

- Choose rounding if you want tidy totals.

🔹 Taxes, Service Charges & Regional Norms

Prices and tipping customs vary by country. Some places show VAT included on menus, others add sales tax at checkout. A few venues include a service charge automatically—if so, you usually don’t add another tip unless service was exceptional.

| Region / Situation | What’s typical | How to use the calculator |

|---|---|---|

| United States (sales tax added) | 15–20% on the pre-tax amount for table service. Delivery 10–15%. | Enable Pre-tax and enter local sales tax (e.g., 8.875%). Tip base becomes pre-tax automatically. |

| Canada (GST/HST/PST added) | 15–20% common for full service; check province rate. | Turn on Pre-tax and enter the combined tax for your province. |

| EU/UK (VAT included in menu price) | Service charge may appear on the bill (10–15%). If included, extra tip is optional. | If a service charge is listed, you can leave tip % at 0 or add a small extra if desired. Usually keep Pre-tax off. |

| Automatic gratuity (large parties) | Some restaurants add 12.5–20% automatically for groups. | If gratuity is added, set Tip % to 0 to avoid double tipping, or add a small extra only if warranted. |

| Counter service / takeaway | Often 0–10% or a small coin/digital tip. | Enter a modest Tip % (e.g., 5%). Keep Split at 1 unless sharing. |

| Cash payments | Round to a convenient total. | Use “Round total to whole unit” so you can pay exact notes/coins. |

🔹 Service Charge vs. Tip

- Service charge: Added by the venue, sometimes mandatory; often distributed by the employer.

- Tip (gratuity): Voluntary; usually goes to staff according to local policy.

- To avoid double tipping, check your receipt for a service charge line before adding a tip.

Traveling or dining in another currency? Convert your total or per-person share first with our Currency Calculator, then apply the tip locally.

🔹 How to Use the Tip Calculator

- Enter the bill: Type the total on your receipt. Pick a currency or type a custom symbol (e.g.,

LVL,AED). - Choose a tip %: Use presets (10–20%) or enter any percent. Adjust based on service quality and local etiquette.

- Split the bill: Set how many people are paying. The tool shows both per-person tip and per-person total.

- Pre-tax (optional): If your region adds tax at checkout, enable Pre-tax and enter the tax rate so the tip is calculated on the service value.

- Rounding: Pick the mode that matches how you plan to pay (cash-friendly totals or exact per-person amounts).

🔹 Which Rounding Should I Use?

| Rounding Mode | Best For | Effect |

|---|---|---|

| No rounding | Card payments; precise accounting | Exact math to 2 decimals |

| Round tip to whole unit | Leaving a neat, simple gratuity | Tip becomes a whole number; total adjusts |

| Round total bill to whole unit | Cash payments with notes/coins | Total becomes a whole number; tip re-derived |

| Round per-person total to 2 decimals | Even splits among friends | Each person pays a tidy 2-decimal amount |

🔹 Pro Tips

- Uneven orders? Have each person calculate their own share, then use the split just for shared items.

- Service charge on bill? If you see a service/gratuity line, set Tip % to 0 or add a small extra only if warranted.

- International travel: If the bill/receipt is in a different currency, convert first with your bank’s rate, then tip in the local norm.

🔹 Edge Cases & Troubleshooting

If numbers look off, check these common pitfalls. The calculator is strict about inputs so totals remain accurate and easy to verify on a receipt.

| Issue | Why it happens | Fix |

|---|---|---|

| Tip feels too high with tax added | You’re tipping on a tax-inclusive bill where etiquette expects pre-tax. | Enable Pre-tax and set the local tax rate (e.g., 8.875). The tool will tip on the pre-tax base. |

| Totals don’t divide evenly per person | Some splits create repeating decimals. | Select Round per-person to 2 decimals for clean, fair shares. |

| Service charge + extra tip | Receipt already includes a mandatory gratuity. | Set Tip % to 0 or add a small extra only for exceptional service. |

| Unexpected currency symbol | Custom symbol overrides the dropdown. | Clear the custom field or retype your desired symbol (max 3 chars). |

| Inputs show big arrows/spinners | Some themes force large number spinners. | Our CSS hides them within this block; refresh cache if you still see them. |

| Need whole-number total for cash | Coins/notes make exact change awkward. | Choose Round total to whole unit. The tool re-derives the tip to match. |

🔹 Accuracy Notes

- All math uses decimal arithmetic with two-decimal display unless rounding rules specify otherwise.

- Per-person rounding does not change the true grand total—only the displayed per-person amounts.

- For audits, record values before rounding and note your chosen rounding rule on the receipt.

🔹 Equal vs. Proportional Split

You can split a check evenly or in proportion to what each person ordered. Your calculator supports either approach: use Split between for equal splits, or calculate each person’s share first and enter the final people count just to display per-person totals.

| Method | When to use | How to do it |

|---|---|---|

| Equal Split | Everyone ordered similarly, or the group prefers simplicity. | Enter full bill, pick tip %, set Split between to the number of diners. Optional rounding for cash-friendly totals. |

| Proportional Split | Different order sizes or alcohol vs. no alcohol; fairness matters. | Add up each person’s pre-tip share first (their items + shared items/people). Tip each share by the same % and add tax/service charges as applicable. |

🔹 Proportional Split Formula

Let s_i be person i’s pre-tip share and r the tip rate (e.g., 15% → 0.15).

Then each pays:

tip_i = s_i × rtotal_i = s_i + tip_i(plus their share of tax/service charge if used)

If you prefer tipping on pre-tax only, compute each s_i without tax, tip it, then add back that person’s tax portion.

🔹 Proportional Example

| Person | Pre-tip share si | Tip (15%) | Total |

|---|---|---|---|

| A | €22.00 | €3.30 | €25.30 |

| B | €14.50 | €2.18 | €16.68 |

| C | €19.00 | €2.85 | €21.85 |

| Group | €55.50 | €8.33 | €63.83 |

Want to sanity-check the math when people order unevenly? First compute each person’s pre-tip share, then verify the group total equals the receipt before applying the same tip rate across the board.

🔹 Mobile Payments & Digital Tipping

Card terminals and QR menus often prompt for tips with preset buttons (e.g., 12%, 15%, 18%, 20%). Those prompts may default to higher percentages or apply the tip to a tax-inclusive total. Use the calculator first to choose a fair percent and rounding rule, then enter a custom amount on the terminal if needed.

| What to know | Why it matters | What to do |

|---|---|---|

| Preset buttons | May anchor you to higher tips than you intended. | Calculate your ideal tip here, then choose custom on the device. |

| Pre-tax vs. post-tax | Terminals usually tip on the final (tax-included) amount. | If you prefer pre-tax etiquette, enable Pre-tax in the calculator and enter that number manually at checkout. |

| Service charge already added | A separate gratuity prompt can cause double tipping. | Check the receipt; if a service charge exists, set Tip % to 0 or add a small extra only if warranted. |

| Splitting with friends | One card often pays the whole bill, then others reimburse. | Use Split between to show exact per-person totals. Share the figure in your chat app. |

| Cash-friendly totals | Coins/notes make exact change awkward. | Select Round total to whole unit before you pay. |

If the device blocks custom tipping or shows unfamiliar currency, compute the tip with this tool and confirm the final number with staff before completing payment.

🔹 Frequently Asked Questions

0 in the calculator, or leave a small extra only if service was exceptional.

🔹 References & Sources

Key materials consulted for tipping etiquette, tax concepts, and service charge distinctions used in this page.

| Source | What we referenced | Link |

|---|---|---|

| Emily Post Institute — Tipping Etiquette | Common U.S. ranges for restaurant, delivery, bar; notes on when to adjust. | general-tipping-guide |

| U.S. Sales Tax Basics (Tax Foundation) | Sales tax is usually added at checkout; rationale for pre-tax tipping preference. | taxfoundation.org |

| Canada Revenue Agency — GST/HST | Overview of GST/HST/PST applied on restaurant bills; provincial differences. | canada.ca/en/revenue-agency |

| UK Government — VAT Guidance | VAT generally included in menu prices; interaction with optional tips/service charge. | gov.uk/vat-businesses |

| UK HMRC — Tips, Gratuities & Service Charges | Difference between discretionary tips and mandatory service charges. | gov.uk/tips-at-work |

| Hospitality Industry Guidelines (various) | Typical ranges for cafés, hotels, and counter service; cash-rounding practices. | restaurant.org |